By Charis Palmer, The Conversation

The G20 leaders have reaffirmed a commitment to raise global growth, saying if more than 800 agreed measures are “fully implemented”, GDP will grow by an additional 2.1% by 2018, adding more than US$2 trillion and “millions of jobs” to the global economy.

Infrastructure and trade were the lead items in the communique, with support for a global infrastructure hub to be funded with both public and private money, and reforms to facilitate trade by “lowering costs, streamlining customs procedures, reducing regulatory burdens and strengthening trade-enabling services”.

The leaders also committed to reducing “unacceptably high” youth unemployment, pledging to invest in apprenticeships, education and training and incentives for hiring young people and encouraging entrepreneurship.

A surprise firm commitment to reduce the gender workforce participation gap by 25% by 2025 was also included, with the aim of bringing more than 100 million women into the labour force.

The leaders also endorsed the “bail in” work of the Financial Stability Board to help protect taxpayers in the event of a bank failure, and welcomed the progress of the OECD on multinational tax avoidance. “Profits should be taxed where economic activities deriving the profits are performed and where value is created,” the leaders affirmed.

An anti-corruption action plan was also endorsed, which includes recovery of the proceeds of corruption and denial of safe haven to corrupt officials.

Climate change, which threatened to overshadow the broader growth agenda, was included in the communique, however it remains up to the United Nations to establish a protocol or other legal instrument for action. The leaders reaffirmed their commitment to phase out fossil fuel subsidies.

Our panel of experts responds below.

Richard Holden, Professor of Economics at UNSW Australia Business School

The G20 have agreed on a range of measures intended to increase GDP by 2.1% more than it would otherwise be by 2018. It’s always hard to put precise numbers on the benefits of complex policies, but there was a lot to like in the G20 communique.

Importantly, there was discussion not just about the level of growth, but the stability of growth — something that the 2008 financial crisis reminded us cannot be take for granted. The endorsement of the Financial Stability Board’s so-called “bail in” proposal is particularly notable. This would help ensure the ongoing viability of financial institutions suffering a major shock, while making the equity holders and unsecured creditors, rather than governments, wear the losses. This, in turn, should reduce the kind of moral hazard that emanated from private profits but socialised losses.

The communique also addresses global profit shifting by large corporations, stating “profits should be taxed where economic activities deriving the profits are performed and where value is created”. Although this is easier said than done, international cooperation and information sharing is indispensable in preventing a race to the bottom, with countries lowering tax rates and offering special deals to attract corporations.

Also notable was the commitment to closing the gender gap in workforce participation by 25% by 2025. It will be interesting to see what specific policies are enacted to this end. One that should be first in line is to reduce the absurdly high effective marginal tax rates that women in the workforce often face because of reductions in child-care and other benefits, combined with income tax schedules. This is a huge barrier to participation and could easily be addressed.

Dr John Kirton, Co-director, G20 Research Group, University of Toronto

When it was proudly proclaimed in February (the growth target) was 2% above the base line then, that was 3.6% for the year we’re in now. Now we know what the real baseline is, it’s less, it’s 3.3%. The commitment was actually “more than 2%” and 2% is no longer good enough, so we need at least 2.3% and even that assumes 100% compliance in implementation…and you never get 100%.

On the other side of the agenda I was extremely encouraged by the Ebola statement, not just because it’s the first time the G20 has taken up global health governance. It really did prove that when leaders get along together you can throw away the narrow economic playbook and do bigger bolder things.

Tony Makin, Professor of Economics at Griffith University

In the five years before the 2008-09 North Atlantic crisis average world economic growth was around 5.0% per annum, but has since averaged 3.5%, and is likely to reach only 3.2% this year. The Brisbane Action Plan to lift world economic growth by over 2% in the next five years is therefore well-timed and laudable. The plan commits G20 economies to expanding production by close to a half a per cent higher per annum on average, exactly the amount Australia’s growth has to rise to return to its long term pre-crisis rate.

Bolstering world economic growth is critically important because it has been the single most important reason for freeing hundreds of millions of people from poverty in populous emerging G20 economies like China, India, Indonesia and Brazil. Pro-growth action is also needed to lower persistently high levels of unemployment in advanced economies, most notably amongst youth in Europe, and to push Australia’s unemployment rate back down below 6%. Higher growth is also important for maintaining living standards in economies with rapidly ageing populations.

Of course economic growth literally has to be fuelled and the associated environmental trade-off also has to be addressed, as it will be front and centre at next year’s G20 summit in Turkey.

What the best means to growth are is subject to often intense macroeconomic debate. In most basic terms, economic growth can be improved via policies that promote aggregate demand or spending, by policies that promote aggregate supply, or some combination of the two.

The G20 heavily emphasised the former via fiscal stimulus when attempting to extinguish the firestorm generated by the North Atlantic banking crisis in 2008-09. However, for many economies including Australia, massive fiscal stimulus was the wrong type of extinguisher to use, like spraying water instead of foam on an electrical fire. The legacy of Australia’s fiscal stimulus is further discussed here.

The Brisbane Plan signifies a major sea change in macroeconomic policy thinking by the G20 for it shifts focus toward structural reform to raise economies’ productive potential. The key measures include hundreds of country specific measures, including promoting competition, enhancing international trade and boosting female workforce participation (critical for economies like Japan).

Quantifying how much the announced measures will actually contribute to global growth will however be a major challenge for IMF and OECD economists and involve much guesswork given the inherent noise in GDP measurement.

Infrastructure investment is also expected to contribute significantly to the 2%+ expansion of world growth. This is the most risky element of the package of measures announced. To the extent it gives licence to governments to spend on poorly chosen infrastructure projects, it signifies international policy recidivism since it would simply be unsound fiscal stimulus by another name.

Fabrizio Carmignani, Professor, Griffith Business School

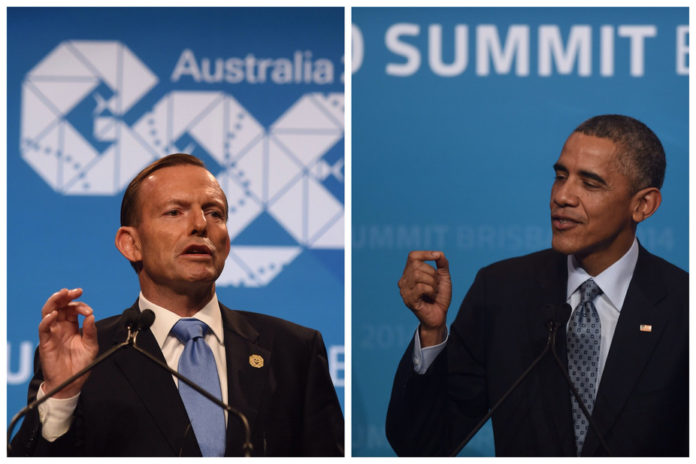

The communique explicitly refers to inclusiveness. Prime Minister Abbott also explicitly referred to the notion of “inclusive” growth. This is certainly an important achievement: it means the leaders are aware growth in itself is a necessary, but not sufficient to generate development and improve living standards. However, the rhetoric of the communique (and of Mr Abbott in the press conference) seems to suggest the leaders equate inclusiveness to job creation. Certainly, to be inclusive, growth must be associated with a steady increase in employment. But it is not just that. Inclusive growth also means taking into account the needs of those who do not have a job or that are not looking for a job (e.g. the elders, youth in school age, the unemployed) through a solid system of social protection, the provision of public goods to guarantee equality of opportunities, and counter-cyclical macroeconomic policies to reduce volatility. Unfortunately, there is not much mention of these other aspects of inclusiveness in the communique.

As expected, the communique does not provide a blueprint for growth. In fact, I do not think that this was ever meant to be its scope. Even the Brisbane Action Plan (in spite of the opening headings) is not really a blueprint for growth in each country. It is instead a list of a few, generally sensible, issues relating to economic interdependencies and spillovers in the global economy. I do believe that it is important for the G20 to discuss and highlight such interdependencies in policy-making. Still, the design and implementation of a blueprint for growth is very much a national issue. Different strategies are required in different countries at different times. While some problems are common across countries, others are country-specific. For this reason, the G20 should have not dictated a “one-size-fits-all” approach to growth, but instead it should have provided direction, leadership in implementation, and – as noted – a thorough discussion on global interdependencies. I think that this has been achieved, even though I believe that too much faith is being placed in the communique (and in the rhetoric of the Australian government) on physical infrastructure development.

As I anticipated, not having climate change on the agenda did not mean environmental sustainability issues were not discussed. I am glad to read references to sustainable growth and development in the communique (and also in the press conference). I think, however, that the leaders should have more clearly emphasised the fact that there is no conflict between environmental sustainability and growth. Much of the thinking on this theme is still anchored to the view that growth requires some degree of environmental degradation or, alternatively, that environmental protection requires some form of de-growth. In fact, there should be no trade-off between sustainability and growth. The great potential for innovation today is in green technologies and we know that innovation is the key to long-term growth. So, growth objectives and policies do not need to be seen as a threat to the environment. I wish the communique had more explicitly made this fundamental point.

AJ Brown, Professor of Public Policy & Law at Griffith University, Transparency International Australia board member, and T20 adviser to the G20 Anti-Corruption Working Group.

The G20 has maintained its credibility as a global governance body by tempering its economic growth mission with an ongoing commitment to fighting global corruption.

Corruption costs the world economy, and all the people it affects. A decade ago, one World Bank estimate put the global cost of corruption at $1 trillion per annum. More recently, the OECD suggested that if corruption were an industry, it would be the world’s third largest, now worth more than $3 trillion and 5% of global GDP. Indeed, “corruption kills”, as Elena Panfilova, head of Transparency International Russia, told a key international conference on anti-corruption and the G20 in Brisbane in June, in the lead up to November 2014 G20 leaders’ summit.

However even though there is some real progress on key anti-corruption issues, and this is thanks to Australian government leadership, there are also signs that it continues to be dealt with as something of a token problem rather than being fully integrated into the G20 agenda.

The G20’s adoption of new high level principles on beneficial ownership – identifying the real owners of the ‘shell’ companies routinely used to hide corruption and evade tax – is a real step forward. US President Barak Obama even made direct reference to the importance of this breakthrough, in his final press conference after the conclusion of the summit.

However, now the questions start about how this commitment is really going to be implemented. Most if not all G20 countries are already subject to international Financial Action Task Force commitments to require this information to be kept and shared, and yet most have not been implementing them. The United States is the most problematic example, with states like Delaware still specialising in selling totally anonymous companies to those who want them, around the world.

Similar questions surround the accountability of G20 countries for their progress on other issues, which is routinely self-reported as high. Even though progress is being made on issues, the reality on many indicators is that is not as spectacular as the diplomo-speak would have everyone believe. And this is true even of Australia’s own self-reporting of its progress.

Another sign of the tensions lie in the decision of G20 leaders today to establish a new four-year G20 Global Infrastructure Initiative, chaired by Australia, but despite the focus on kick-starting major new infrastructure, there is no direct reference in the four-page initiative to managing the corruption risks of this exercise, apart from short reference to “best practice procurement” processes and the need to manage any conflicts of interest among the companies who may contribute to the fund.

In the long-term, the effectiveness of the G20 relies on its credibility. On anti-corruption issues, that credibility has been maintained for now, but it is clearly going to take a lot more work, including by Australia, for it to be sustained in the long term.

Ross Guest, Professor of Economics and National Senior Teaching Fellow at Griffith University

The commitment to freeing up international trade is by far the most important outcome of the G20 summit. Forget the nonsense about growth targets – they are largely beyond the control of governments. And the infrastructure hub is over-hyped and should make any taxpayer nervous. Governments love infrastructure – tangible transport links, ports and so on play well to the voters especially in marginal electorates. But they must come with rigorous prior cost-benefit tests, otherwise it’s taxpayer dollars down the drain. There must be no more of the talk that came with the NBN: “This is visionary, huge, wonderful and far too complex to be subject to cost-benefit analysis – we’ll just do it!” Governments must demonstrate that the resources cannot be put to better alternative use – either in the private or public sectors – otherwise we are all worse off.

Freeing up international trade does not require higher taxes or more government spending – it just requires less barriers to imports which usually come in the form of contrived regulations on standards, or old-fashioned quotas and import taxes. With lower barriers to imports we get better and cheaper goods and services, more competition which drives efficiency, and incentives to invest in our most productive sectors.

![]()

This article was originally published on The Conversation.

Read the original article.