Victor Odundo Owuor, University of Colorado

In times of conflict, many economies flounder. Investors and the private sector tend to be averse to risk, and will avoid putting money into countries where peace and security are not guaranteed.

But new research we’ve conducted, which focuses on several African states – among them Nigeria, Cote d’Ivoire and Ethiopia – suggests there may be an alternative funding source that nations could harness during times of crisis: diaspora investment.

Many diaspora members are already contributing financially to their countries of origin through remittances. Remittances are funds sent by members of the global diaspora to family and friends in their countries of origin. The World Bank estimates that US$466 billion in remittances were sent to low and middle income countries in 2017.

The data we reviewed show that while foreign direct investment wanes during times of conflict, diaspora remittances either remain stable or increase. That’s because remittances are usually directed at people’s friends or relatives, who particularly need support when a country is at war or embroiled in conflicts.

This is a form of investment that could serve as a critical lifeline for private sector development and economic growth in even the most difficult of investment climates.

The same motivations which compel diaspora members to send remittances may also make them more willing to invest in times of instability, serving as a resilient source of capital in fragile contexts.

A closer look

To understand the likely resiliency of diaspora investment when compared to other forms of foreign direct investment it’s necessary to compare the data on conflict intensity, foreign investment inflows, and remittances.

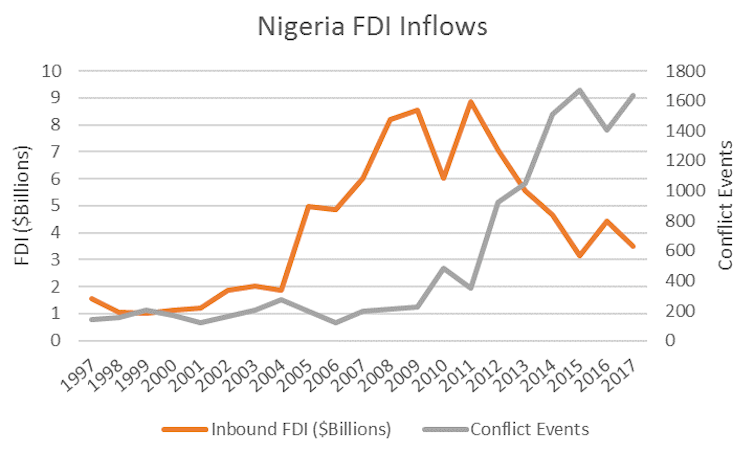

Nigeria is one example.

Conflict intensity – defined here as the number of conflict events recorded in a country during a particular period – remained relatively stable from 1997 until the late 2000s. This period also saw sustained growth in foreign direct investment inflows, which increased more than five-fold. However, with the spike in conflict, driven largely by the rise of Boko Haram and an increase in violence in the Middle Belt, in the late 2000s, coupled with the global financial crisis, foreign investment dropped dramatically. In 2017, foreign investment in Nigeria stood at only 40% of its peak in 2011.

Spikes in conflict in 2010 and 2017 were mirrored by drops in investment, while a relative decline in conflict intensity in 2016 saw a significant increase in money flowing in. Obviously, there are a variety of factors at play. But this case demonstrates a fairly tight correlation between foreign direct investment and conflict intensity.

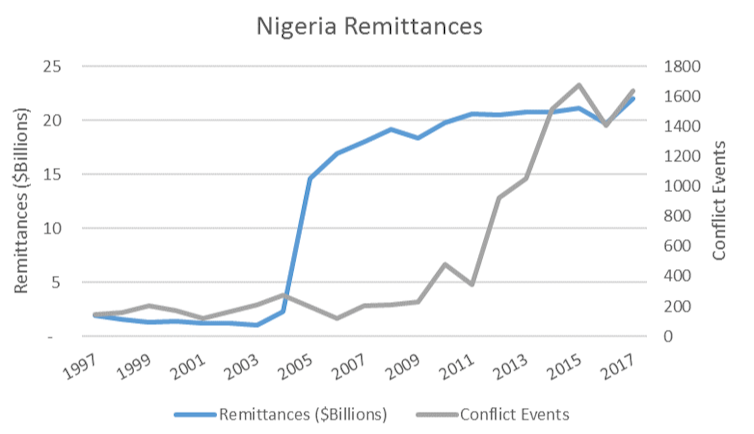

Now, compare this to trends in Nigerian remittance flows over the same period.

Remittances were relatively stable from 1997 to the mid 2000s, which saw a massive increase, followed by another period of relative stability and slight growth. What is telling is that there does not appear to be any negative relationship between remittance inflows and conflict. From 2009, a period of increased conflict and volatility in Nigeria, there was very little variation in remittance flows. It is feasible, then, that diaspora investment, if motivated by many of the same factors as remittances, could be considerably less prone to conflict-induced capital flight than other forms of foreign investment.

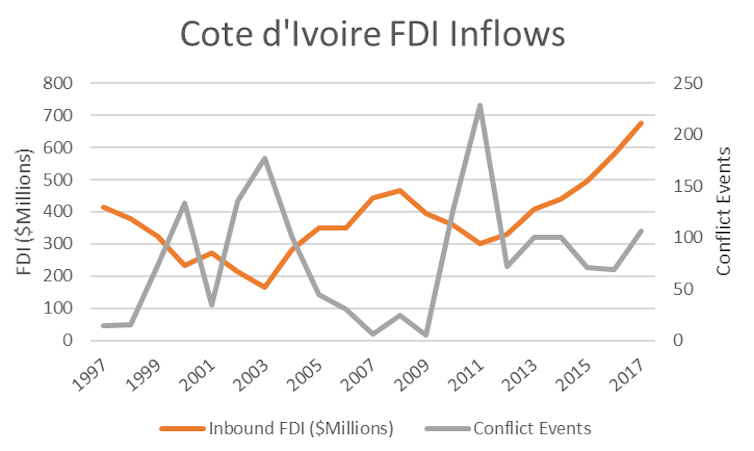

Cote d’Ivoire fits the same pattern.

From 1997 to the early 2000s, the country saw increased conflict intensity and significantly declining foreign direct investment. This was followed by a period of very little conflict in the mid to late 2000s. This period saw significant increases in foreign investment. The spike in conflict in 2010 and 2011 triggered an investment decline. Since 2012, the conflict has levelled off and this has been accompanied by sustained foreign investment.

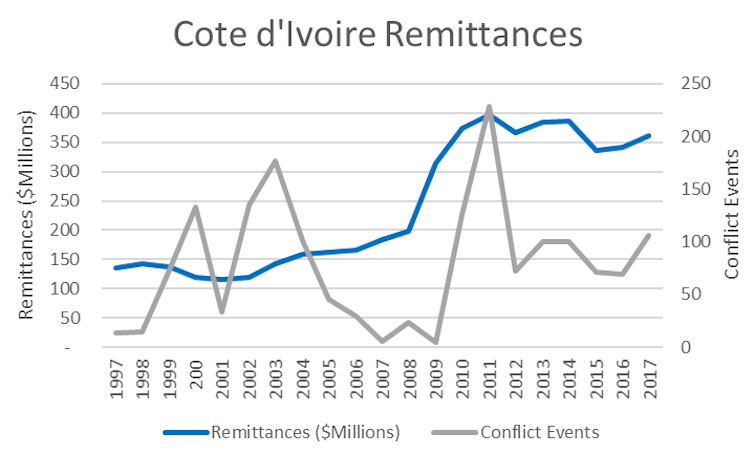

Here again, remittances demonstrate greater stability in the face of conflict. Remittances were largely stable during both periods of increased conflict.

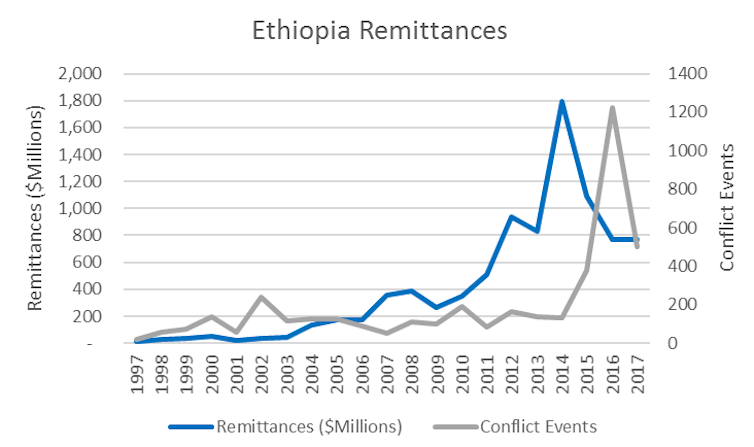

It’s important to note that we found some exceptions, Ethiopia among them. There, remittances appeared stable for years before a large increase which corresponded with increases in foreign direct investment. However, they declined dramatically after 2014, two years prior to a spike in violence.

This demonstrates that the relationship between foreign investment, remittances and conflict intensity is not always clear cut. But the larger data does appear to indicate that a relationship exists between these factors.

Importantly, our research echoes other studies, including one by the World Bank which found that remittances remain stable and even increase during times of crisis such as natural disaster, economic crisis, or conflict.

Diaspora to the rescue

So, what does all of this mean for diaspora investment in particular? The same diaspora groups who are remitting to family and friends during conflict may be willing to make investments in their countries of origin while other forms of foreign capital are in flight.

Diaspora investors often consider factors beyond protecting and maximising return on their capital. So they are likely to be a more stable source of investment in conflict impacted states at precisely the time when investment is most needed.

Currently, very little of the money that’s sent home as remittances is saved, invested, or used to generate income as it goes to meeting immediate needs such as food, housing and health care. This limits its capacity to spur economic growth and development.

This can be changed in several ways. For instance, country of origin governments and financial institutions can provide more diversified investment mechanisms for potential diaspora investors. They can facilitate diaspora investment by demonstrating clear links between investment options and development and conflict recovery.

Academic, multilateral and civil society entities can also provide basic research on diaspora investor preferences, and technical assistance on structuring investment options.

Additional research was done by Jay Benson, a researcher at the One Earth Future Foundation’s research department. His areas of specialisation are peacekeeping, civilian protection and development finance. He has previous experience at the US State Department, and the University of Denver’s Pardee Center for International Futures, and Program on Terrorism and Insurgency Research.![]()

Victor Odundo Owuor, Senior Research Associate-One Earth Future Foundation, University of Colorado

This article is republished from The Conversation under a Creative Commons license. Read the original article.