Protecting the American Investor by Championing Human Rights

How Under Secretary of State Krach Put Wall Street on Notice

by Michael Mink – January 18, 2020

Washington D.C. — Under Secretary of State Keith Krach and his team have been outspoken and vigorous advocates for average American investors. Their words and actions have accomplished much to protect them from unknowingly funding the Chinese military or the Chinese Communist Party’s human rights abuses. Krach believes that “most Americans have no idea that their own money—held in pension funds, 401Ks, and brokerage accounts—is financing Chinese companies that support the People’s Republic of China’s (PRC’s) military, security, and intelligence apparatus, as well as human rights abuses on an epic scale, such as those in Xinjiang. Through a web of subsidiaries, index funds, financial products and lack of proper disclosure, the average American investor is involuntarily supporting Chinese companies.”

Championing Human Rights

“By running U.S. economic diplomacy,” Krach said on Cavuto Live’s Fourth of July show, “I have come to learn that nowhere are the CCP’s human rights abuses more pronounced than in the Xinjiang region’s mass internment camps. Citizens, institutions, and companies must be made aware that the CCP’s large-scale human rights abuses, which include forced abortion, forced sterilization, abuse of women, forced marriage, and forced labor, result in cultural and religious genocide.” “We are holding China accountable,” Krach told Fox Business’ Maria Bartiromo. “They’ve attacked in Hong Kong freedoms of the press, freedom of speech, freedom of assembly, and rule of law.” He followed up with an op-ed titled “US businesses must take a stand against China’s human rights abuses.”

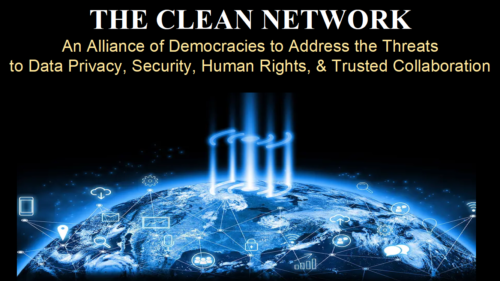

However, Krach and his team didn’t bring their legendary transformational leadership skills from Silicon Valley to DC to write op-eds and make TV appearances. Instead, he masterminded the Clean Network to address the long-term threat to security and human rights posed by the CCP. This Alliance of Democracies, which the Wall Street Journal calls an undisputed bipartisan and enduring success, serves as a catalyst for waking up citizens of the world to the truth about the CCP’s human rights abuse and their three-prong strategy of concealment, co-option, and coercion. As Krach puts it, “the CCP’s concealment of the virus resulted in the pandemic, its co-option of Hong Kong has eviscerated the freedoms of its citizens, and its relentless coercion of the Uyghur people has continued in the brutal internment camps of Xinjiang.”

Leveraging the Clean Network

The Clean Network is a powerful alliance that enables government leaders and global CEOs to stand together against the CCP’s increasingly aggressive bullying tactics and human rights abuses. It also gave Krach a platform to shine the light of transparency on the CCP from every angle possible—from government, to business, universities, pension funds, stock exchanges, financial institutions, the press, and civil society. As Ed Kinsey, Krach’s top senior advisor on financial matters says, “Hit them where it hurts, the pocketbook.”

Perhaps most importantly, Krach and Kinsey leveraged that light of transparency to protect American investors and pension holders from unknowingly perpetuating human rights abuses by financing the biggest threat to democracy that the world has ever seen. Strategically, the Clean Network offers an ideal beachhead to build a worldwide human rights movement of Clean Portfolios with Clean Funds.

Advising U.S. Businesses

Warning against the risks of China investments, on July 1, 2020, Krach sent a letter to all U.S. CEOs, asserting their duty to establish governance principles when it comes to investing in entities that directly or indirectly facilitate human rights abuses and Chinese military buildup. He urged pension funds, mutual funds, insurance companies, venture capital firms, institutional investors, and emerging index funds to disclose Chinese investments to their constituents and consider divesting from investments that pose a risk of financing China’s human rights violations.

| Krach stated that Chinese companies’ financial practices are opaque for a reason and do not comply with Sarbanes-Oxley transparency provisions, which puts all investors at risk. |

Calling on University Endowments

On August 18, 2020, Krach also sent a letter to the governing boards of American universities, alerting them to the threats posed to university endowments by Chinese Communist Party companies on the entity list or that contribute to human rights violations. Krach’s warning to the governing boards of higher education institutions extended to guidance regarding risk reduction due to China’s financial practices. He advised, “Divesting would be prudent in the likely outcome that enhanced listing standards lead to a wholesale delisting of PRC firms from U.S. exchanges by the end of next year. Holding these stocks also runs the high risks associated with PRC companies having to restate financials.” He also urged them to consider publicly disclosing all Chinese company holdings to their campus communities, “especially the PRC companies in emerging markets index funds.”

| Krach told the endowment boards that they “have a moral obligation, and perhaps even a fiduciary duty, to ensure that your institution has clean investments and clean endowment funds.” |

Informing Pension Holders

On December 8, 2020, Krach issued a U.S. Department of State fact sheet titled “US Investors Are Funding Malign PRC Companies on Major Indices,” which listed 13 PRC firms on the Commerce Department’s Entity List, 35 parent-level Communist Chinese Military Companies (CCMCs), and 71 affiliates on the Department of Defense’s List of CCMCs that are included in MSCI, FTSE and Bloomberg emerging market index funds.

These malign PRC companies are being financed with the help of the $10.7 trillion invested in more than 5,000 U.S. pension systems through the use of emerging market index funds. This includes all 401k’s of the 10 largest U.S. companies; all 10 of the top federal contractors; all 20 of the largest state pension plans; All six of the largest target-date mutual-fund providers; and the Pension Benefit Guaranty Corporation with $131 billion in pension insurance reserves. Kinsey said, “ MSCI and FTSE Index Funds are racing against the clock to divest over 50 Chinese stocks before prices drop.”

Kinsey emphasized that these Chinese companies are engaging in activities contrary to the national security and foreign policy interests of the United States, which includes supporting PRC military development, human rights abuse in Xinjiang, surveillance violations, and helping the Chinese military construct and militarize the South China Sea.

Forewarning Stock Exchange Delistings

Krach’s December 8th fact sheet highlighted that CCMCs, China Mobile Ltd., China Telecom Corp. and China Unicom Hong Kong Ltd. are on the New York Stock Exchange and warned investors that these Chinese company’s stocks have increased risk due to being subject to sanctions, public protests, trade restrictions, boycotts, delisting and other punitive measures that jeopardize their business and profitability. On January 7, 2021, The New York Stock Exchange announced the delisting of the three major Chinese telecommunications firms. China Telecom Corp. shares dropped 9.4% and China Mobile Ltd. fell 7.2%, closing at their lowest prices since 2008 and 2006 respectively. China Unicom’s stock slid 11%.

| Bloomberg noted, “As far back as August, Undersecretary of State Keith Krach wrote a letter warning universities to divest from Chinese firms ahead of possible delistings.” |

Cautioning Financial Institutions

On January 14, 2020, Krach issued a U.S. Department of State fact sheet titled “Communist Chinese Military Companies Listed Under E.O. 13959 Have More Than 1,100 Subsidiaries,” expanding the list of companies that are prohibited for US investment to 44 parent-level CCMCs and 1,108 subsidiaries, cross referenced to MSCI’s and FTSE’s major indexes. Krach stressed that ample notice had been given to compliance officers and risk managers about disclosing the material risk to their constituents. Krach and Kinsey also warned CEOs and their boards about their legal duty to be in full compliance and take decisive action to minimize any negative effect on their clients’ holdings due to imminent divestment.

On January 14, 2020, Krach issued a U.S. Department of State fact sheet titled “Communist Chinese Military Companies Listed Under E.O. 13959 Have More Than 1,100 Subsidiaries,” expanding the list of companies that are prohibited for US investment to 44 parent-level CCMCs and 1,108 subsidiaries, cross referenced to MSCI’s and FTSE’s major indexes. Krach stressed that ample notice had been given to compliance officers and risk managers about disclosing the material risk to their constituents. Krach and Kinsey also warned CEOs and their boards about their legal duty to be in full compliance and take decisive action to minimize any negative effect on their clients’ holdings due to imminent divestment.

| Ample warning has been given to public and private equity compliance officers and risk managers to understand and disclose to their constituents the material risk associated with investments identified in the Executive Order. CEOs and their boards now have a legal duty to implement and be in full compliance with the Executive Order. They also may have a fiduciary duty to take decisive action to minimize any negative effect on their clients’ holdings due to the imminent divestment of CCMCs. Best practices in material risk mitigation, disclosure, and transparency are essential to proper corporate governance. |

Enlisting the Press

Krach and Kinsey asked the press to shine the light of transparency on the CCP’s efforts as a matter of national security and ensure that the American people are not used as fundraising tools of an authoritarian state hostile to U.S. interests. He asked journalists to tell American investors to call their fund managers and ask about any CCMC investments in their portfolio to guard against potential losses due to imminent divestment.

Krach and Kinsey asked the press to shine the light of transparency on the CCP’s efforts as a matter of national security and ensure that the American people are not used as fundraising tools of an authoritarian state hostile to U.S. interests. He asked journalists to tell American investors to call their fund managers and ask about any CCMC investments in their portfolio to guard against potential losses due to imminent divestment.

During a conference call with reporters on Jan. 14, Krach declined to comment on the interagency decision process to exclude these tech giants from the Pentagon’s blacklist but claimed there is ample open-source documentation showing these companies are strategic to the Chinese military.

| Please tell American citizens who are investors and pension holders that their fund manager should notify you if your investments are contributing to the Chinese Party’s military buildup, the surveillance state, and human rights abuses. If you have not been notified by January 30th, call them. Ask them if you are exposed. If you are exposed, ask them the name of the companies, the amount and when you will be divested. Then ask them why they do not directly and clearly disclose to you. If they do not get a satisfactory answer, best to find a new fund manager. |

Inspiring Civil Society

On January 18, 2020, Krach sent a letter to all civil society organizations saying that they have always been leaders in exposing the world’s inequities and injustices. “It is critical,” Krach said, “that you remain at the forefront of the shared effort to secure the free world against rising authoritarianism.” Linking the various dimensions of authoritarian risks, combining the actions of various sectors, and uniting under the global Clean Network Alliance of Democracies creates a network effect that has the power to be an exponential force for good in promoting democratic principles over authoritarianism.

On January 18, 2020, Krach sent a letter to all civil society organizations saying that they have always been leaders in exposing the world’s inequities and injustices. “It is critical,” Krach said, “that you remain at the forefront of the shared effort to secure the free world against rising authoritarianism.” Linking the various dimensions of authoritarian risks, combining the actions of various sectors, and uniting under the global Clean Network Alliance of Democracies creates a network effect that has the power to be an exponential force for good in promoting democratic principles over authoritarianism.

Krach continued, “After serving as the CEO of public companies and chairman of the board of Purdue University, I have learned that leadership in the face of challenges starts with the core principle of transparency. Visibility results in accountability. This is precisely where Your organizations have the ability to codify clean values into governance principles that will serve as an example to others throughout the world. I urge you to partner only with organizations that are not financing the CCP’s egregious behavior.”

Perpetuating Government Policy

Krach has been a vocal advocate within the U.S. Government for continuity of policy concerning the multiple lists of malign foreign companies. At a press conference, he gave the example that only 7 of the 44 companies on the Defense Department’s list of Communist Chinese military companies are on the Commerce Department’s Entity List. He recommended that the next Administration harmonize the various agency lists to advance U.S. national security and address the unprecedented scale of the challenge. He asserted that if a company is barred from receiving sensitive technology, then it should also be barred from obtaining U.S. investment. Krach also argued for better coordination with allies in Korea, and argued for better coordination with allies in Korea, Japan, and Europe. He warned that issuing licenses that place a company’s profits over national security interests is short sighted.

| There is important work to be done on continuity of policy in aligning the Defense Department list of CCMCs with the Commerce Department Entity List, and the Military End User list. |

Memorandum on Protecting United States Investors

from Significant Risks from Chinese Companies

In a recently published memorandum on protecting U.S. investors from China-related risks, Kinsey reiterate, “For decades, Chinese companies have availed themselves of the benefits of U.S. financial markets, and capital raised in the U.S. has fueled China’s rapid economic growth. While China reaps advantages from American markets, however, the CCP consistently prevents Chinese companies with significant operations in China from abiding by the investor protections that apply to all companies on U.S. stock exchanges. It is both wrong and dangerous for China to benefit from our capital markets without complying with critical protections that investors in those markets rightfully expect and deserve. China’s actions to thwart our transparency laws raise significant risks for investors.”